Diversification is a cornerstone principle of sound financial management and a key strategy for maximizing the potential of your investment portfolio. The idea behind diversification is simple: by spreading your investments across different asset classes, industries, and geographical regions, you can reduce the risk of significant financial losses and improve your chances of steady returns. This article will explore how diversification works, why it’s crucial for long-term financial success, and how you can implement it in your portfolio.

What Is Diversification?

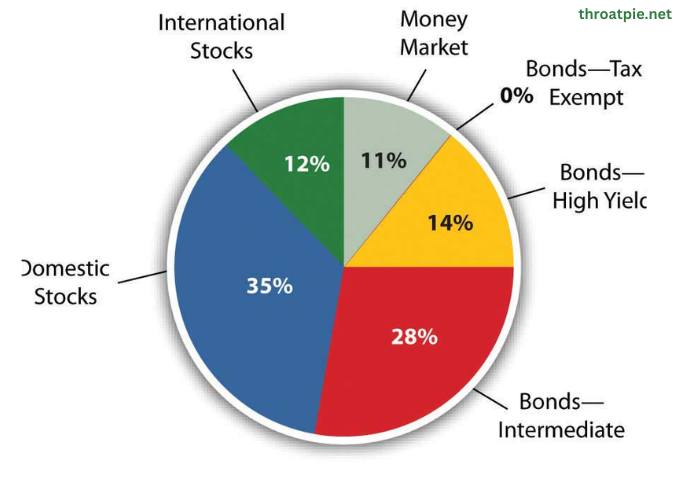

At its core, diversification involves allocating your investments across various asset types, such as stocks, bonds, real estate, commodities, and even alternative assets like private equity or cryptocurrency. The goal is to avoid putting all your eggs in one basket. In doing so, you lower the risk of your entire portfolio suffering if one investment underperforms.

The Importance of Diversification

- Risk Reduction: By holding a variety of assets, you spread the risk. While one investment may perform poorly, others might perform well, balancing out the losses. For example, stocks and bonds often perform differently depending on market conditions. In times of stock market volatility, bonds can provide stability.

- Smoother Returns: A diversified portfolio typically experiences less volatility than one concentrated in a single asset class. Over time, this can lead to more stable returns, which is crucial for long-term financial growth, especially if you’re saving for retirement or other long-term goals.

- Maximizing Growth Potential: Different asset classes and sectors often thrive under different economic conditions. By diversifying, you increase your chances of benefiting from growth in multiple areas of the economy. For instance, while technology stocks may be soaring, sectors like utilities or healthcare may offer consistent returns even in times of economic uncertainty.

- Mitigating Specific Risk: Diversification helps you manage both systematic risk (market-wide risks that affect all investments) and unsystematic risk (specific risks that affect individual investments). By spreading your investments, you limit exposure to any single company or industry’s problems.

Key Areas for Diversification

- Asset Classes: The most fundamental type of diversification involves spreading your investments across different asset classes. Common options include:

- Stocks: Shares in individual companies or exchange-traded funds (ETFs) that track the stock market.

- Bonds: Debt instruments issued by governments or corporations. Bonds tend to be more stable and less volatile than stocks.

- Real Estate: Real estate investments, such as rental properties or real estate investment trusts (REITs), provide income potential and long-term value.

- Commodities: Investing in physical assets like gold, oil, or agricultural products offers a hedge against inflation and economic instability.

- Cash Equivalents: Money market funds, certificates of deposit (CDs), or other short-term, low-risk investments ensure liquidity and safety in your portfolio.

- Geographical Diversification: Diversifying geographically means investing in different regions, such as domestic, international, or emerging markets. Global diversification can reduce risk because economic conditions vary across countries, and different regions may not be affected by the same factors at the same time. For instance, a global downturn in one region might not have the same impact on other countries.

- Industry Diversification: Spreading your investments across different industries or sectors (such as technology, healthcare, energy, and consumer goods) ensures that your portfolio isn’t overly reliant on any one sector’s performance. Industry-specific diversification can help buffer against economic cycles that may affect particular sectors.

- Time Horizon Diversification: Consider diversifying your portfolio based on your time horizon. Short-term investments typically involve lower-risk, more liquid assets like cash and bonds. Long-term investments, such as stocks or real estate, can offer higher returns, but they come with increased volatility. Tailoring your diversification strategy to your financial goals and timelines can optimize your returns while managing risk.

How to Implement Diversification

- Assess Your Risk Tolerance: Before diversifying, it’s essential to understand your risk tolerance. Your risk tolerance is influenced by factors like your age, income, financial goals, and the length of time you can leave your investments untouched. Younger investors typically have a higher risk tolerance, while those closer to retirement may prioritize stability.

- Choose Diversified Investment Products: For those who lack the time, expertise, or resources to manage individual assets, there are numerous diversified investment products. Mutual funds, index funds, and ETFs are all excellent options for achieving diversification. These funds pool money from multiple investors and spread it across various asset classes, industries, or regions, offering broad exposure to the markets.

- Monitor Your Portfolio Regularly: Diversification isn’t a one-time strategy. The performance of your portfolio may shift over time, so it’s important to review it regularly. Rebalancing, which involves adjusting the weightings of your assets, is a common strategy to maintain the desired level of diversification and align it with your risk tolerance.

- Stay Informed: Economic conditions, interest rates, and market trends can all impact the effectiveness of your diversification strategy. Keeping up-to-date with financial news, market reports, and any changes in your personal circumstances ensures that your portfolio remains aligned with your goals.

Conclusion

Diversification is a powerful tool for managing risk and maximizing the potential growth of your financial portfolio. By spreading your investments across various asset classes, industries, and regions, you can achieve a balanced and resilient portfolio that reduces the impact of market volatility. Whether you’re a seasoned investor or just starting out, incorporating diversification into your financial strategy is essential for long-term success.

Remember, the goal of diversification isn’t just to protect yourself from losses but also to position your portfolio for growth. With thoughtful planning, regular monitoring, and a diversified approach, you can help ensure that your financial portfolio thrives, regardless of the market’s ups and downs.